Few investors trade altcoins to maximize their BTC holdings.

They miss out.

Trading altcoins to get more BTC require very little effort and can double, triple or even quadruple your BTC bags over time.

With The Trading Dashboard, you can apply this strategy successfully spending only 10 minutes a month.

How It Works

The Trading Dashboard is what enables you to consistently make successful long-term trades without spending hours glued to the screen.

What does it mean to trade altcoins?

Since the inception of altcoins, the cryptomarket has moved in cycles.

In some periods, everyone wants Bitcoin. In others, everyone wants altcoins.

When everyone wants Bitcoin, Bitcoin rallies in price, but altcoins lag behind.

When everyone wants altcoins, the opposite happens: altcoins rallies way more than Bitcoin.

Trading altcoins means that we sell what has already rallied to buy what is about to rally.

BTC and altcoins takes turns rallying. Going back and forth between BTC and altcoins, holding whatever is rallying at the moment, is the easiest way to make money trading altcoins.

It is also predictable.

I'm confused...

Look, you don't need to worry about finding the next altcoin that'll go 100x. When I say "altcoins", I literally mean that it is enough to get a bunch of decent altcoins, like Solana and Chainlink.

So, when altcoins are rallying you might put 20% of your money in Solana and 20% in Chainlink. When BTC is about to rally, you want to sell most of your Solana and Chainlink to BTC.

You simply want more BTC before it rallies because then more of your portfolio will benefit from the growth.

Who can trade altcoins?

Trading altcoins is easy and can be done by everyone who:

- Invest in BTC and altcoins.

- Are able to spend 10 minutes a month checking The Trading Dashboard

Why Indicators?

Indicators tell you if you should buy BTC or altcoins because they indicate what is about to rally.

They are more consistent than price targets because they are dynamic. That is, they respond to changes in the market.

The Trading Dashboard tells you what the indicators are suggesting we should buy.

A new summary is provided every Sunday.

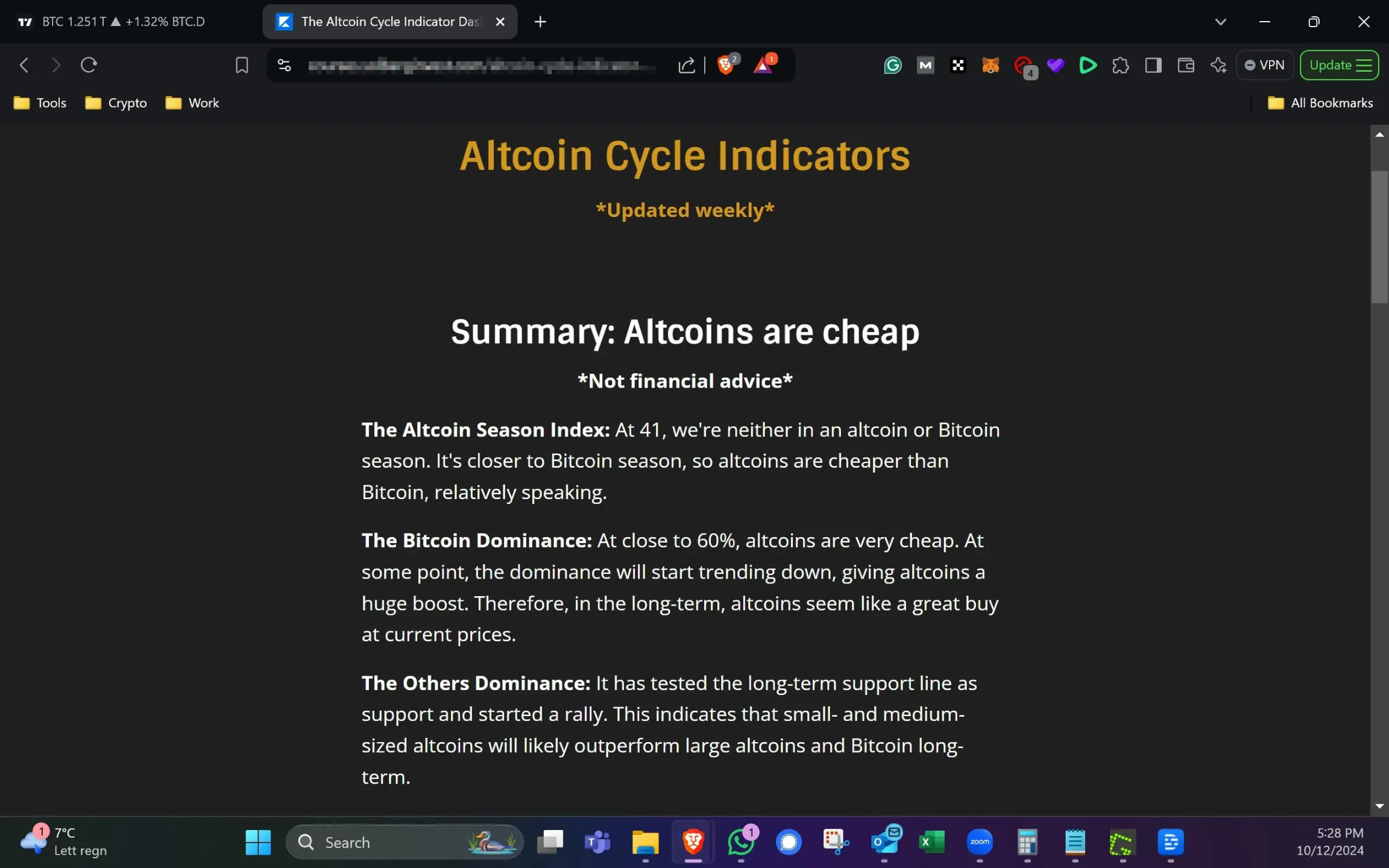

Here's a snapshot from the summary on 24. Nov, 2024:

Read more about the indicators below:

I

The Altcoin Season Index

The Altcoin season Index is a number between 1 and 100. The number equals the percent of the top 50 altcoins (excluding stablecoins) that have outperformed Bitcoin in the past 90 days.

For example, if the index is at 45, it means that 45% of the top 50 altcoins have outperformed Bitcoin in the past 90 days.

Altcoin Season = Above 75.

Bitcoin Season = Below 25.

We want to buy Altcoins during Bitcoin season and sell altcoins during altcoin season.

II

Bitcoin Dominance

Bitcoin dominance measures Bitcoin's share of the total cryptocurrency market capitalization.

When Bitcoin Dominance is high, it means Bitcoin holds a larger part of the market, and that altcoins are cheap relative to Bitcoin.

When Bitcoin Dominance is low, it indicates that altcoins are expensive relative to Bitcoin.

Example:

If the total cryptocurrency market is worth $1 trillion and Bitcoin's market cap is $700 billion, Bitcoin's dominance is 70%. If the total crypto market grows to $1.5 trillion but Bitcoin remains at $700 billion, Bitcoin Dominance drops to around 46.7%, indicating a shift in investment towards other altcoins.

Therefore, we want to hold altcoin when the Bitcoin dominance decreases.

III

The Others Dominance

Others Dominance measures the market share of altcoins below the top 10 in terms of market capitalization.

When Others Dominance is high, small- and medium-sized altcoins collectively hold a significant portion of the market.

Conversely, a low Others Dominance signifies that the majority of investment is concentrated in the top 10 cryptocurrencies.

Example:

- If the total cryptocurrency market is valued at $1 trillion and the market cap of altcoins outside the top 10 sums up to $100 billion, Others Dominance is 10%.

- If the total market cap increases to $1.5 trillion but the market cap of these smaller altcoins remains at $100 billion, Others Dominance would decrease to about 6.67%.

Therefore, we want to hold more small- and medium-sized altcoins than large altcoins when Others Dominance increases.