Toncoin (TON)

Sep 01, 2024Toncoin, in simple terms:

Toncoin is a cryptocurrency developed to power "The Open Network" (TON), which was initially conceptualized by the encrypted messaging app Telegram, but later became a standalone community-led project.

Being a Layer 1 project, Toncoin is competing with Ethereum, Solana, BSC, Avalanche and others.

So what makes Toncoin better than the rest?

#1: Scalability - 100K TPS

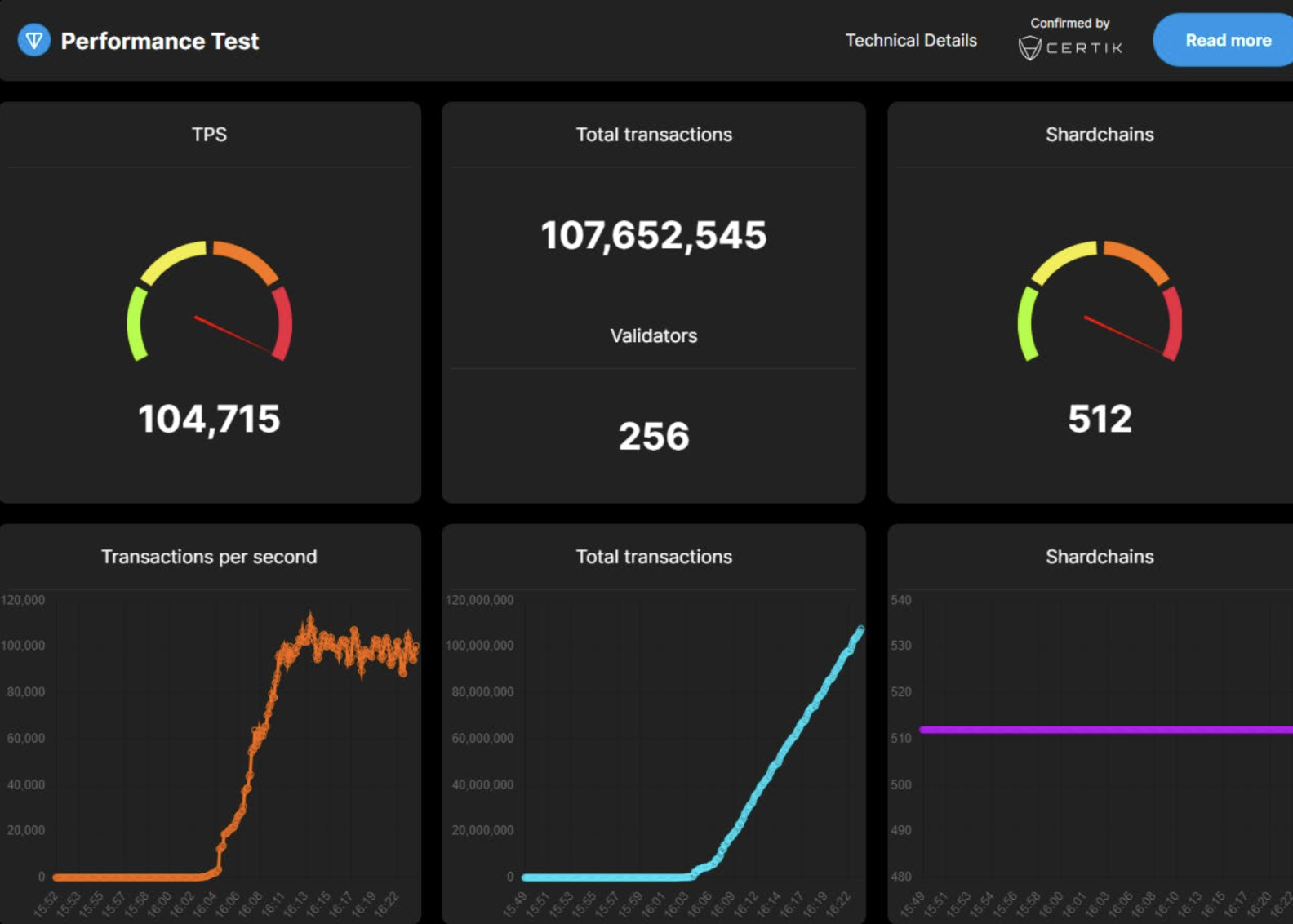

Publicly and well-documented, The TON Foundation conducted a stress test on a separate copy of the blockchain network.

They deployed a "bomb" smart contract that exponentially increased transaction load by cloning itself and continuously transmitting transactions.

The "bomb" simulated the transaction activity of millions of users.

After running for 10 minutes, the network rapidly expanded into 512 so-called "shardchains", processing 90-110K transactions per second until the experiment was manually terminated.

Here you see the results of the test:

If you're a nerd (like me), you can read about the technical details here.

Shardchains - the tech allowing Toncoin to scale up to 100K+ TPS - are essentially smaller partitions of a larger blockchain network.

Each shard operates like a mini-blockchain, handling its own subset of transactions and smart contracts.

Each shard processes transactions in parallel, significantly increasing the overall capacity and speed of the network.

In the test that reached over 100,000 transactions per second, 512 shardchains were created, meaning that each "mini-blockchain" processed on average 205 transactions per second.

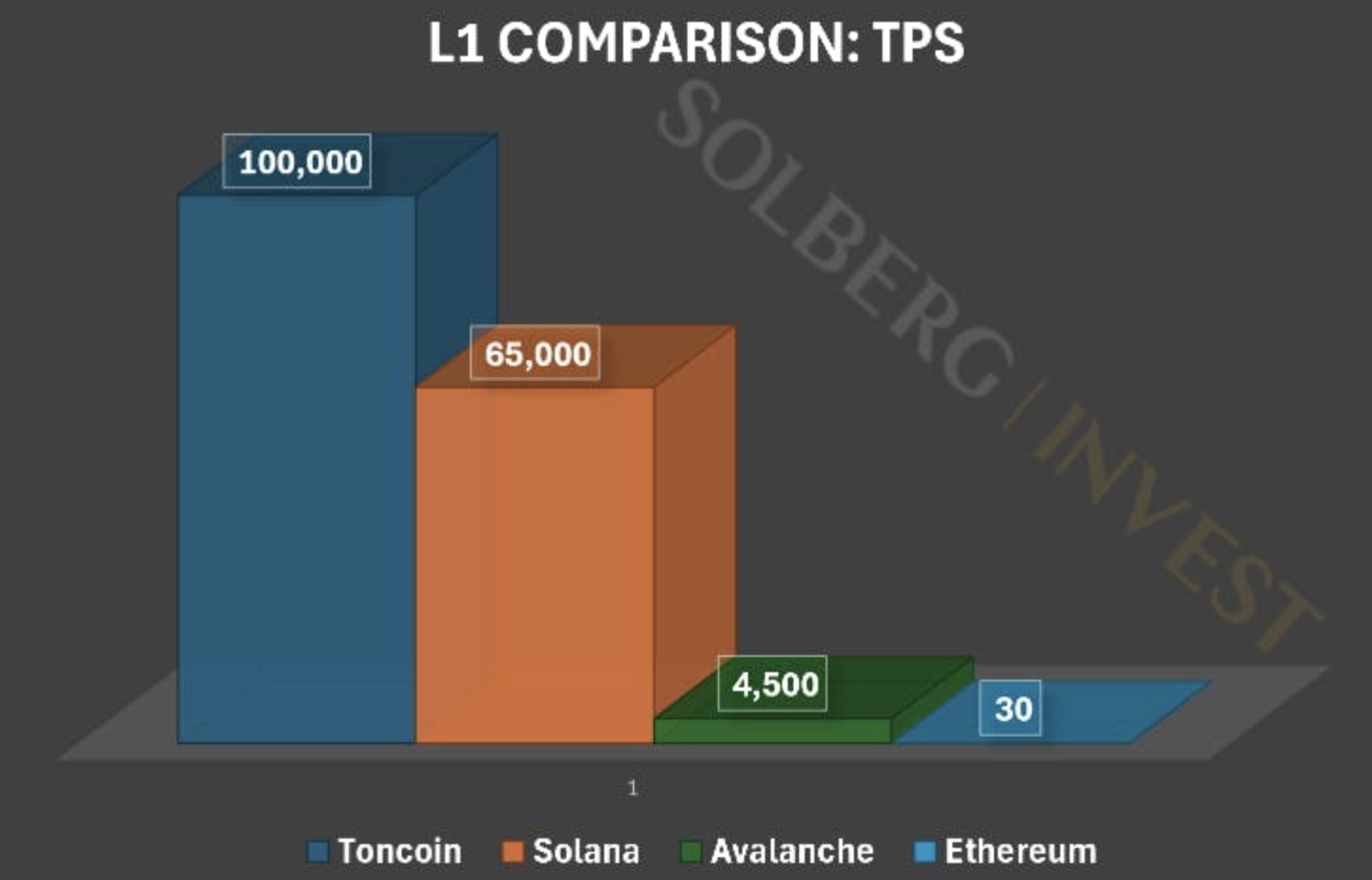

To give you some perspective, check out how Toncoin compares to other L1 in terms of TPS:

Furthermore, for Toncoin to scale they can spawn more shardchains to increase TPS or scale down by collapsing shardchains.

This is called "dynamic sharding".

In theory, Toncoin can scale to millions of TPS.

PS: This is what Ethereum is aiming towards - sharding - to scale up to hundreds of thousands of transactions per second. This is not likely to happen before the next crypto cycle.

#2: Security and Decentralization

TON relies on "Proof-of-Stake". This means that "validator nodes" stake TON to be able to participate in the validation of transactions.

"Validator nodes" are just servers/computers holding copies of the blockchain, continuously adding new transactions and blocks.

Think of validator nodes on TON as the combination of miners and nodes on Bitcoin.

Before adding new transactions to the blockchain, 2/3 of the validator nodes must agree on the legitimacy of the transactions.

If validators try to cheat by adding illegitimate transactions to the blockchain, they are punished and lose their staked TON coins.

For my fellow nerds: They're using a variant of the Byzantine Fault Tolerant protocol. Read more about it on page 44 of the whitepaper.

In summary, TON is using cutting-edge blockchain architecture. They're basically what Ethereum 2.0 promises. This architecture sets TON up for high security and decentralization.

However...

Even though the architecture is great, the security and decentralization depend on the number of validators and their geographical distribution.

Is TON actually decentralized?

Blockchains work like a democracy: validators - people staking the native token, like TON, SOL or ETH - vote on what is "true" to approve transactions and secure the network.

The more voters there are in this democracy, the more decentralized and reliable the consensus is.

Therefore, one way of measuring the decentralization (and security) of a blockchain is to look at the number of validators:

- Toncoin: 377

- Solana: 1,515

- Avalanche: 1,724

- Ethereum: 1,035,076

Ethereum dwarfs the other L1s... It has almost 3,000 times more validators than Toncoin.

Still, with 377 validators TON is decentralized, just not to the same degree as others.

Furthermore, blockchains like Solana use other consensus algorithms (Proof of History) that are inherently more centralized than the one used by TON (pBFT).

Since TON is fairly young, I expect the number of validators to grow over time, leading to increased decentralization.

#3: Adoption

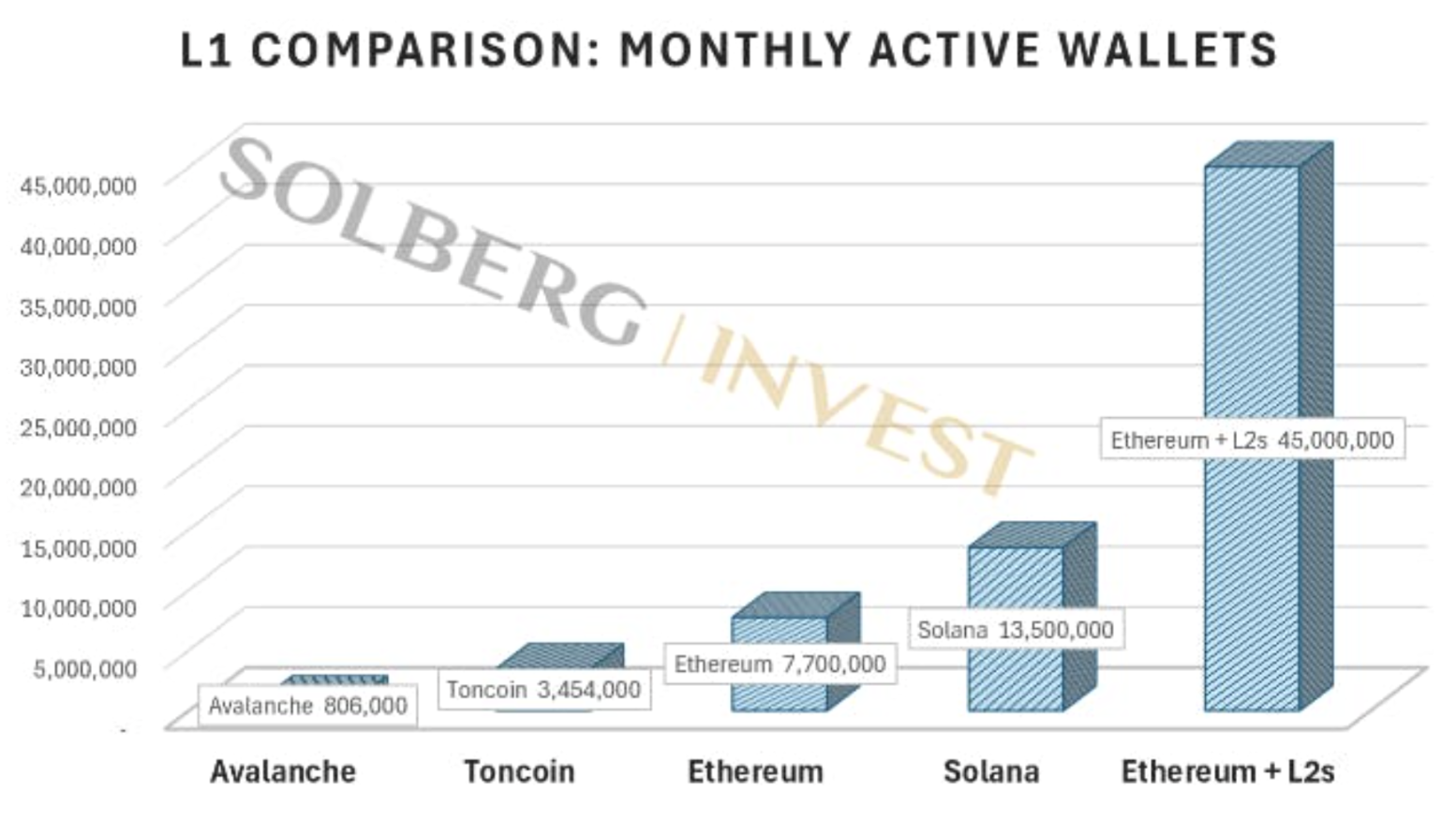

To get an idea of the adoption of Toncoin, I'm going to compare it to other L1s in terms of monthly active wallets, dApps built on it, and TVL in DeFi.

In my opinion, as an investor, adoption is more important than anything else. Just look at memecoins: no use case at all, but loads of adoption makes the price increase exponentially.

I'll later use adoption metrics to compare the valuation (market cap) relative to the adoption.

#1: Monthly Active Wallets

Thanks to on-chain analysis, we can know how many wallets are active on the different blockchains. To count as a monthly active wallet, you need to have made at least one transaction in the past 30 days.

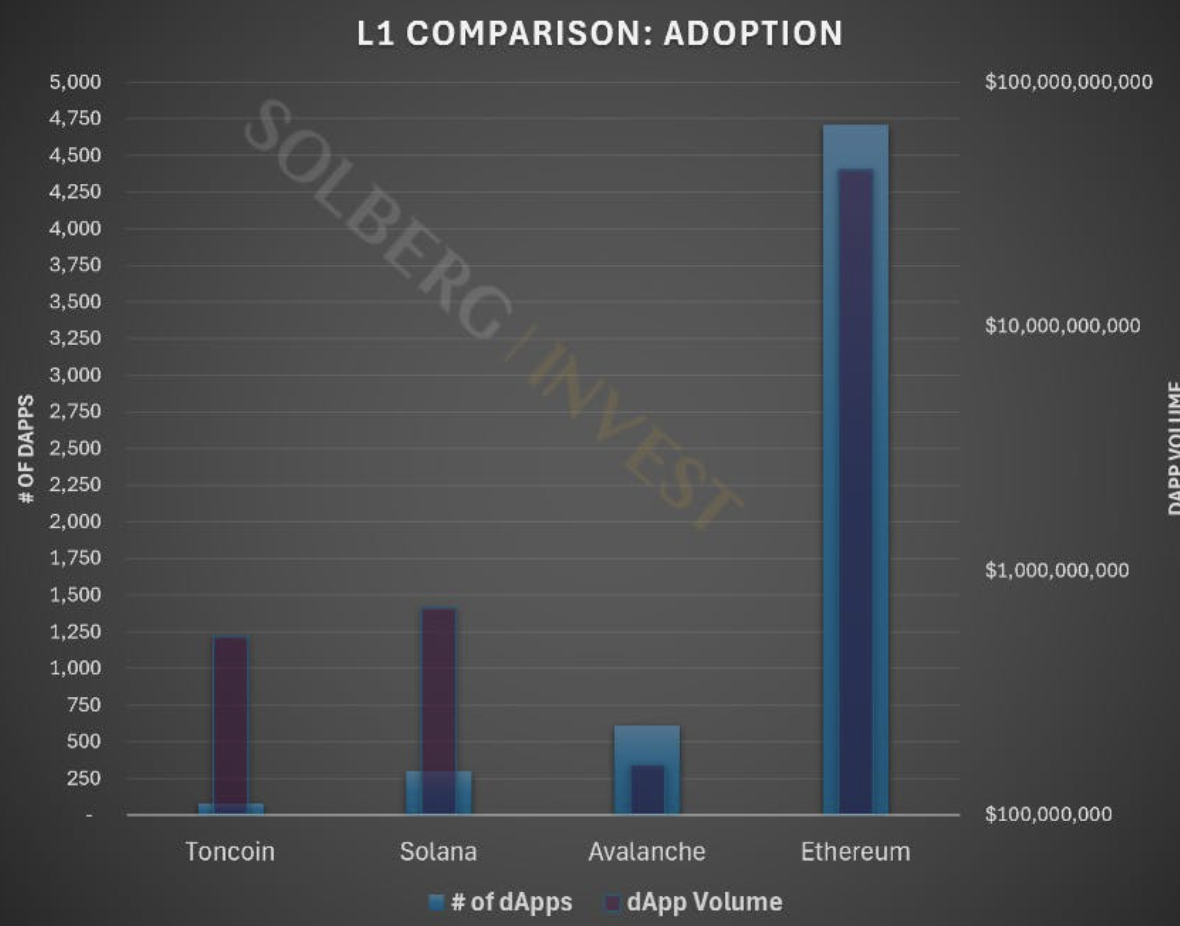

#2: Number of dApps

dApp means "decentralized application". More dApps built on a network indicate higher adoption.

To get the complete picture, I'm also going to look at how much these dApps are being used, measured in transaction volume.

Source: dappradar

Toncoin has few applications built on it, but the volume is comparable to Solana.

Again, Ethereum dwarfs the competition with a volume of two orders of magnitude higher than the others.

#3: TVL in DeFi

TVL = Total Value Locked. It tells us the value locked in DeFi applications built on each chain.

For example, if you decide to lock up $1,000 worth of ETH in Uniswap to earn a yield for adding liquidity for traders, TVL on Ethereum would increase by $1,000.

Here are the exact numbers:

- Toncoin: $1.2 Billion

- Avalanche: $1,6 Billion

- Solana: $11.4 Billion

- Ethereum: $145 Billion

We see Toncoin at par with Avalanche, but one and two orders of magnitude below Solana and Ethereum respectively.

Using these metrics of adoption, I'll now speculate on the future potential price of TON, and calculate the potential ROI of investing at the current price.

Future Potential Price of TON:

Telegram has stated that it aims to onboard 500 million users to Toncoin's blockchain.

Reaching just 1/10th of that equals the current user base of Ethereum + L2s.

The way they're going to achieve this is through revenue sharing from ads on Telegram, stablecoin payments, and casual games.

- Telegram is sharing revenue from ads with TON holders.

- Stablecoin payments are in high demand. USDT has a higher volume than all the top 10 coins combined (including BTC).

- Casual gaming, like Candy Crush and Angry Birds, spreads like wildfire. For example, "Hamster Kombat" has over 200 million users. They have not launched a token on TON yet, but they're planning to do so.

Just the fact that Telegram, which has a vested interest in growing TON, has over 700 million active users is enough to take TON to 50 million monthly active wallets.

If TON reaches 50 million active wallets, which seems realistic, it'll have more than Ethereum + L2 has now.

The question now is: how much might the market grow if TON reaches 50 million active users?

Market cap divided by monthly active users seems fairly consistent across the L1s we've compared today. Using this, we can calculate a future market cap of TON if it reaches 50 million monthly active wallets.

The market cap seems to be between 5,000 and 10,000 times larger than the number of monthly active users.

This gives us a range:

- Low valuation: 5,000 * 50 million = $250 Billion

- High valuation: 10,000 * 50 million = $500 Billion

Given the current market cap of 18 Billion, that's a 14x - 28x in market cap.

To calculate the price increase of TON, we need to figure out the inflation of the token.

Tokenomics:

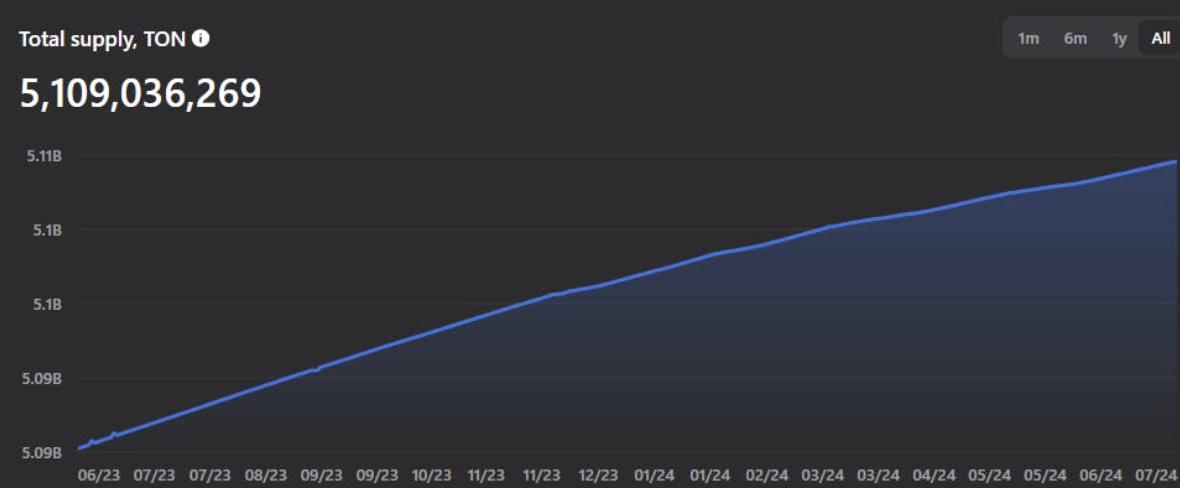

Below you see the circulating supply of TON, going back to June of 2023:

The supply has gone from 5,087 billion to 5,109 billion, which is an inflation of 0.415%.

The low inflation rate is good for TON holders.

As a reminder, the value per token is equal to the market cap divided by the circulating supply. Increasing the supply therefore decreases the price.

Given the more or less non-existent inflation, the price increase will roughly be equal to the market cap increase.

In other words, we can summarize our speculation like this:

IF Toncoin reaches 1/10th of Telegrams stated goal, reaching 50 million monthly active users,

and...

IF the valuation stays between 5,000 - 10,000 times the number of monthly active users,

then, the ROI of investing in TON is 14X - 28X.