Solana (SOL)

Sep 02, 2024Solana, in simple terms

Solana is a layer 1 blockchain that is built to host decentralized applications (dapps).

Through smart contracts, applications can run on the blockchain without centralized authorities.

For example, decentralized exchanges like Jupiter, stablecoins like USDT, and oracle services like Pyth Network are enabled by blockchains like Solana.

Being a layer 1 blockchain, it competes directly with Ethereum, Toncoin, Avalanche, and others.

The question is how is it doing, and why should developers choose Solana?

What makes Solana unique?

Solana was made to solve a "bottleneck" problem.

Similar L1's, like Ethereum, struggle to scale because of limits to the number of transactions they can handle per second.

The number of transactions per second (TPS) is important, because it basically tells how much traffic a blockchain can handle.

A higher TPS means lower fees and smaller chances for congestion.

Ethereum, for example, is known for its low TPS and high fees.

One of the reasons why Ethereum is so slow is that it uses the proof-of-stake consensus mechanism. Proof-of-stake provide high security, but allows for low volumes.

Solana was created with TPS in mind and has a slightly different consensus mechanism.

Proof of History

Using a combination of proof of history (PoH) and proof of stake (PoS), Solana significantly outperforms most L1s.

The question is, what is "Proof of History"?

Instead of every node agreeing on the order of all the transactions, as in Bitcoin and Ethereum, PoH appoints "a leader node" that decides the order of the incoming transactions.

The leader node puts a timestamp on the transactions and tells all the other nodes.

Then, the transactions are verified through normal PoS (like Ethereum and others).

In practice, the PoH mechanism cuts transaction processing time drastically...

...but, the model is centralized.

We'll get more into centralization later.

First, lets check how Solana does in terms of its features compared to competition.

Solana vs. competitors

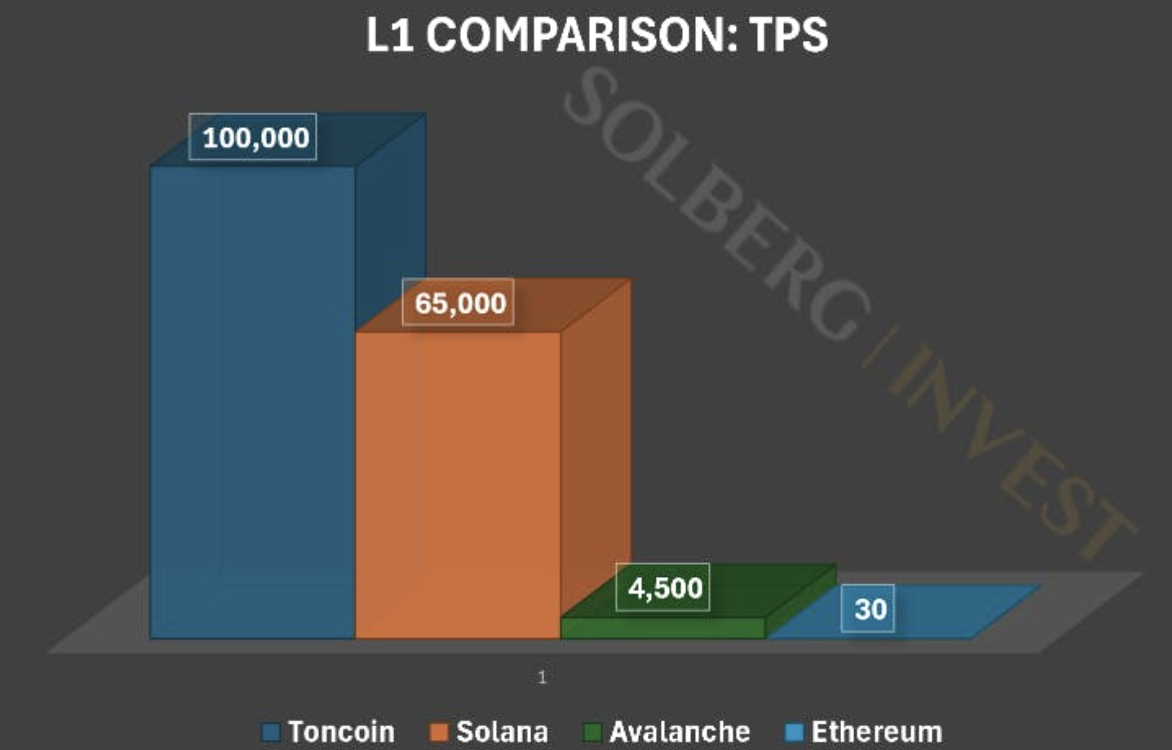

The first ting we want to compare is the top L1s in terms of TPS:

Except for Toncoin, the competitors are not even close to the number of TPS Solana can handle.

This is a huge advantage because it allows a high volume of transaction and low fees.

Low fees are especially important in the realm of decentralized finance and gaming.

Low Transaction Fees

Why is it more expensive to drive a cab than to take the bus?

There's more competition for the seats.

Similarly, there's competition for "blockspace" on the blockchain.

So, the more space in each block (passenger seats), the cheaper the transaction fees (because of less competition).

In addition, the number of cabs and busses affects the price.

If you were at the airport and found ten buses outside, their price per seat would be lower than if there were only one (again, due to competition).

Similarly, the amount of blocks available in a given timeframe affects the transaction fee.

Below you see the block time (the number of busses outside the airport in a given period) and block size (the number of seats per bus) on Solana vs. Ethereum:

These are estimates, but the difference is obvious.

Solana has a much higher capacity, and that is why their transaction fees are way lower than Ethereum.

Actually, Solana is one of the cheapest solutions on the market with fees ranging around $0.00025 - $0.0008 per transaction.

In comparison, fees on the Ethereum network average around $1.

In other words, fees on Ethereum are up to 4,000x higher than fees on Solana.

Why Do Transaction Fees Matter?

Imagine that you're building an application on a blockchain.

A social media platform for instance.

For such an application, each post, each message, everything that happens, would have to be inscribed on the blockchain.

Each of these events would count as a transaction.

Let's look at what would happen if X was built on Solana vs. Ethereum.

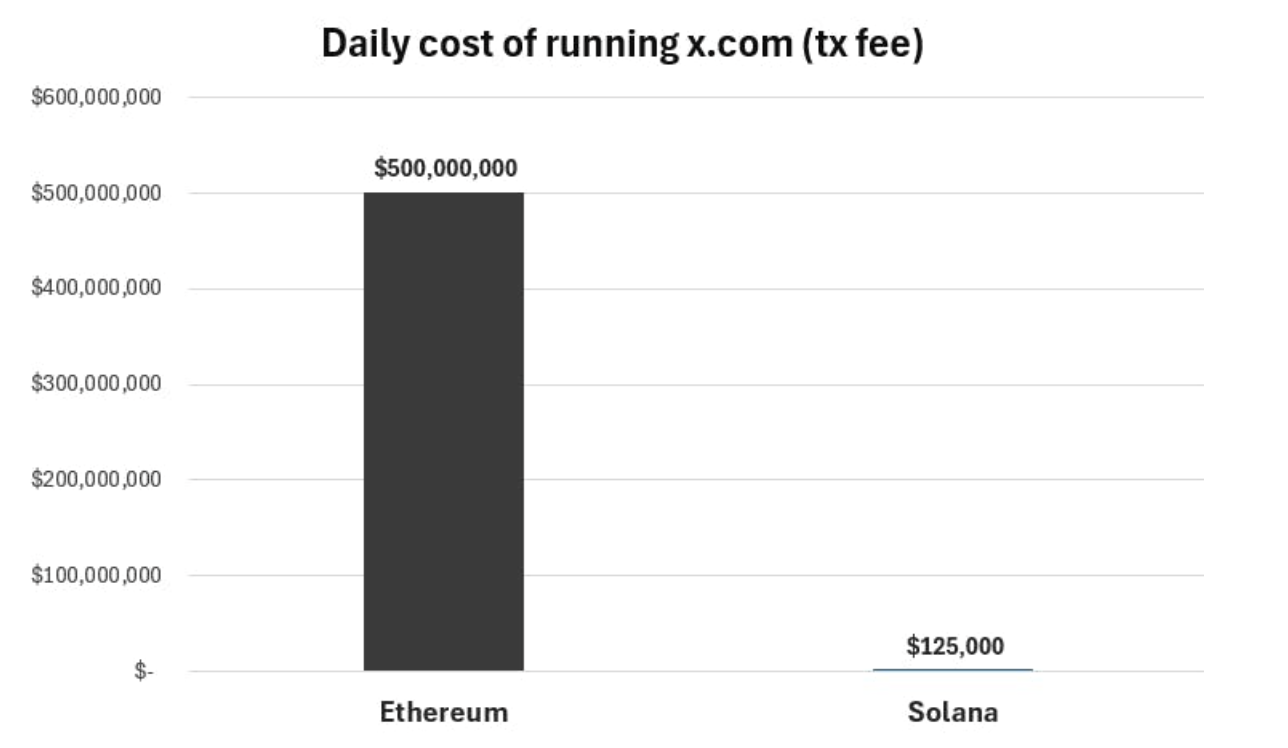

The graph below shows the daily transaction costs for X given an average of 500 million tweets posted every day:

Such an application could never be profitable on Ethereum, but it could work on Solana because of the low fees.

The point of the thought experiment is to show the practical consequences of the differences in fees on Ethereum and Solana.

In short, higher fees means that the dApps have lower margins when it comes to revenue.

They need to earn way more to cover their expenses.

This will be reason enough for many to choose Solana over Ethereum.

The Adoption of Solana

From an investor's perspective, adoption is more important than anything else, so the next section is essential.

To get a sense of the adoption of Solana, I will look at monthly active wallets, number of dApps on the chain and total value locked.

#1: Monthly Active Wallets

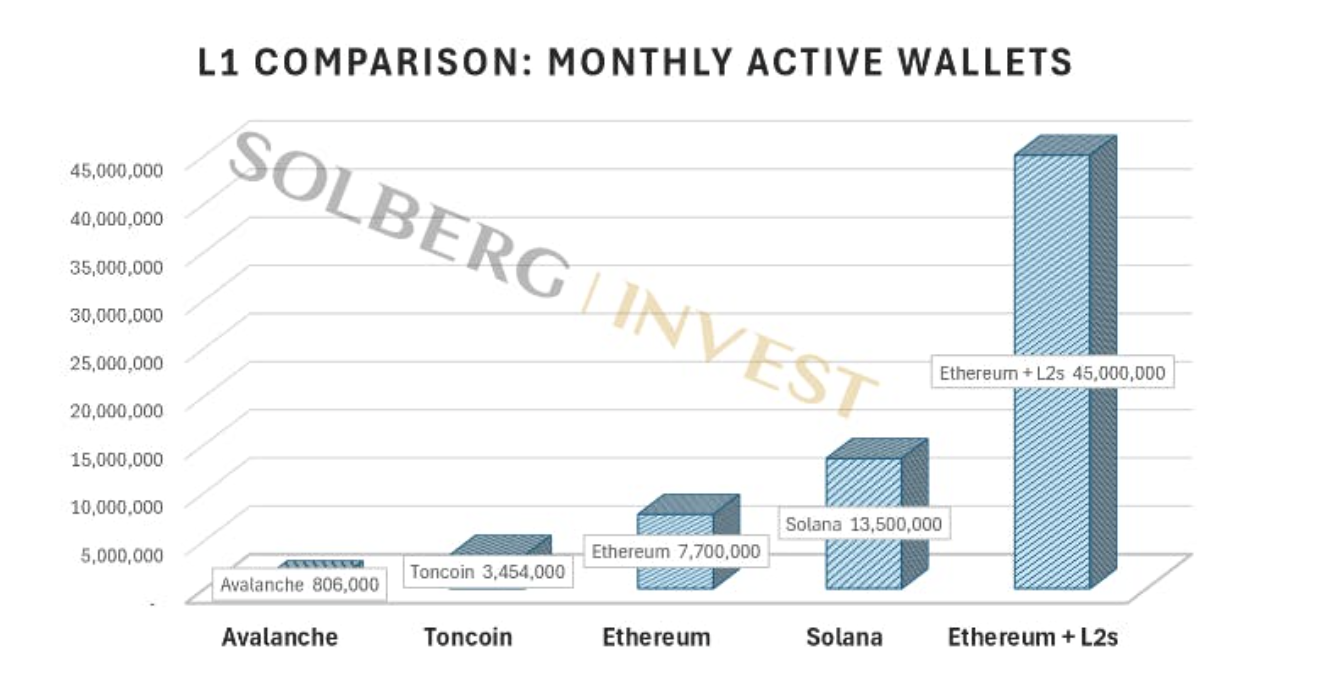

Thanks to on-chain analysis, we can know how many wallets are active on the different blockchains.

To count as a monthly active wallet, you need to have made at least one transaction in the past 30 days:

The combination of Ethereum + all the Layer 2 solutions like Polygon, Arbitrum, Blast, etc. beats Solana. But when looking at each blockchain separately, Solana has the most active users.

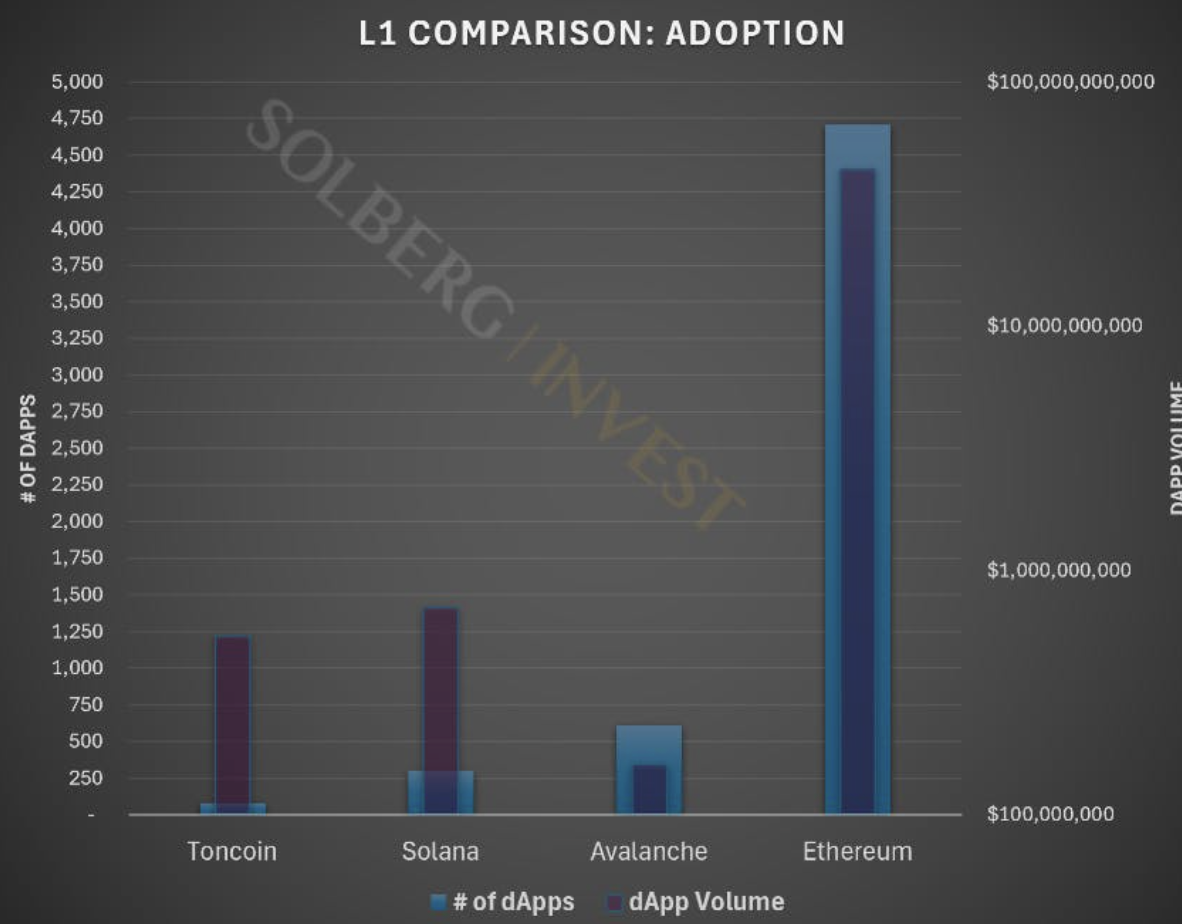

#2: Number of dApps

The function of an L1 blockchain is to host applications (dApps).

Therefore, a large number of dApps is an indication of high adoption and success.

To get the complete picture, I'm also going to look at how much these dApps are being used, measured in transaction volume.

Source: dappradar

Solana has a decent amount of dApps, but what stands out is the volume.

The high volume indicates that the dApps are being used a lot, which means that Solana is being adopted by users and investors.

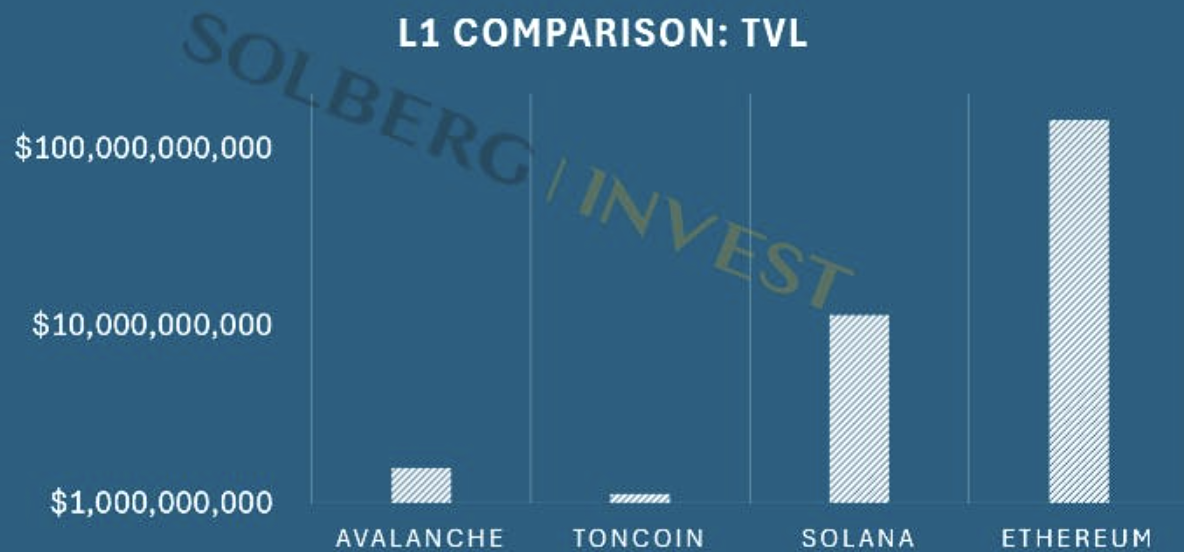

#3: TVL in DeFi

TVL = Total Value Locked. It tells us the value locked in DeFi applications built on each chain.

Higher numbers indicate more adoption, specifically in the decentralized finance sector:

Here are the exact numbers:

- Toncoin: $1.2 Billion

- Avalanche: $1,6 Billion

- Solana: $11.4 Billion

- Ethereum: $145 Billion

As usual, Ethereum is dwarfing competition...

... but, Solana is 10X better than Avalanche and Toncoin in terms of DeFi adoption.

Is Solana Decentralized?

In my opinion, Solana is inherently more centralized than a pure PoS (or PoW like Bitcoin) because the leader node tells all other nodes the order of incoming transactions.

The leader node is therefore a single point of failure.

It is chosen randomly, so all nodes can in theory be the leader from time to time.

This makes the technical requirements for Solana nodes high, as the leader role is demanding.

The high technical barrier to entry limits the number of nodes, as most people can't afford it.

#1 Node Requirements:

- 12-core CPU with 2.8GHz clock speed

- 128/256GB of RAM

- 2-4 NVME drives of at least 1TB

- 10 Gbps Network

This potentially centralizes control among a smaller group of well-resourced operators.

Below you see the number of validators on the different L1s we're comparing:

- Toncoin: 377

- Solana: 1,515

- Avalanche: 1,724

- Ethereum: 1,035,076

Solana is doing better than Toncoin, but way worse than Ethereum.

#2 Validator Distribution:

Validators being spread out geographically is an indication of decentralization. Below you see the geographical distribution of the nodes on the different L1s we're comparing:

- Toncoin: 29 unique countries.

- Solana: 47 unique countries.

- Avalanche: 31 unique countries.

- Ethereum: 97 unique countries.

Solana fares well in this regard. It's way better than Toncoin and Avalanche.

#3 Network Outages:

The network has experienced outages attributed to stress on its centralized components, highlighting vulnerabilities in its infrastructure.

- On the 6th of February 2024, Solana was down 4 hours and 46 minutes.

- On the 25th of February 2023 for almost 19 hours.

- On the 1th of October 2022 for over six hours.

- On the 30th of September 2022 for over one hour.

In total, I found fourteen incidents of varying degrees of seriousness.

To put this in perspective, Ethereum has been running since July 2015 and has NEVER been down.

My take on Solana

As a crypto enthusiast, I don't particularly like Solana. Its downtime is unacceptable and the sacrificing of decentralization for scalability goes against the crypto ethos.

As an investor, on the other hand, I love Solana. I made huge amounts of money holding it in 2021 and I expect it to perform well in the cycle we're in.

Solana's vision is simple: Build the fastest permissionless global order book in the world.

Solana aims to become "The decentralized NASDAQ at the speed of light".

In contrast to 99% of the blockchain projects out there, which aim to "revolutionize the industry", this vision is crystal clear.

Solana needs to optimize for speed, fees, and being permissionless.

And they're doing a good job.

- They're fast enough to handle tens of thousands of transactions per second.

- The fees are extremely low, practically zero.

- Although they lack some degree of decentralization, it is 100% permissionless.

The team behind Solana's upgrades is top-notch, and they continually work to optimize it for those three things.

Their success is obvious, looking at the explosion in daily active users:

The daily active users on Solana 13x'ed from 300K to 4 million over the past 12 months.

What's most important is not the high number, but the growth. Look at Ethereum, which is more or less standing still:

Since June 2022, Ethereum has gone from 8 Million monthly users to about 7.5 Million monthly users.

Nothing is going to change in the short to medium term: Solana will take years to scale.

It's just a matter of optimization:

- Solana - Speed, scalability, and low fees.

- Ethereum - Decentralization, security, and reliability.

In other words:

If you're developing a project that might kill the entire human race if it fails, you're launching it on Ethereum. If you're building a fun game, or launching a memecoin, you're doing it on Solana.

In my opinion, "potentially civilization-ending applications" are not being built on blockchains this decade. "Fun games" and memecoins are.

Therefore, I think Solana will continue to grow faster than Ethereum.

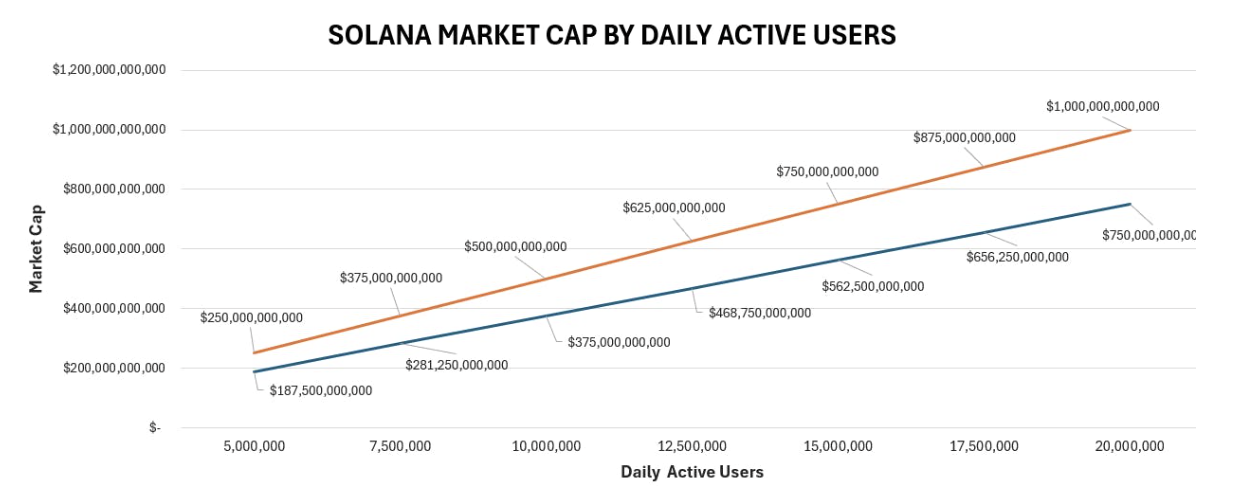

Potential Value of Solana

I'll use the number of active users to get an idea of the potential valuation of Solana in the future.

The current market cap of Solana is $75 Billion, and the daily active users are roughly 4 million.

This puts the "market cap / active users" (MC / AU) ratio at 75B / 4M = 18,750.

Looking at this metric historically, 18,75k is low.

It peaked way over 100K in 2021.

This makes sense, as the valuation exceeds the underlying fundamentals in times of great hype.

Let's assume the market cap peaks at 50,000 times the number of daily active users, as the hype historically decreases with each bull market.

Below you see two lines - orange assuming 50K (high) and blue assuming 37.5K.

With the growth we're seeing now, It's not hard to imagine Solana reaching 10 - 15 million daily users.

All it takes are a couple of big games to release, or for stablecoin payments to take off.

Both PayPal and Shopify have launched, or are launching stablecoin payments using Solana. This will enable a huge majority of the online payments to go over Solana.

Currently, in the Eurozone, over 100 billion transactions are processed annually, which averages 275 million transactions per day.

Catching only a fraction of this will add millions of active users to Solana.

Furthermore, there are roughly 3 billion active gamers globally. Onboarding only a fraction of these to Solana will skyrocket the number of daily users.

Axie Infinity - the huge gaming hit of 2021 - reached 2.8 million daily active players. This proves that it is possible.

If Solana manages to reach 10 - 15 million daily active users, and the MC / AU ratio is between 37.5K - 50K, the market cap will reach $375B - $750B.

Given a supply of 475,000,000 SOL, the price will reach:

Low: $375B / 475M = $780

High: $750B / 475M = $1580