Pyth Network (PYTH)

Sep 02, 2024PYTH, in simple terms:

The Pyth Network (PYTH) is designed to solve the so-called "Oracle Problem".

Blockchains can't access external data (like weather, sports events, or stock prices) because they are closed systems. There is a "gap" between the blockchains and the world outside them.

Oracles are needed to bridge this gap, or to feed the blockchains with data from the outside.

The problem is that Oracles might feed the blockchain with manipulated or false data (with intention or by mistake).

This is a crucial problem for blockchain applications that rely on outside information.

Here's a simple breakdown of the problem, and how Pyth network is solving it.

The Problem

In traditional finance, market data (like stock prices, forex rates, commodities prices, etc.) is essential for trading and investment decisions.

Market data is also essential for many blockchain applications.

However, getting this data reliably and quickly onto the blockchain in a decentralized and trustless way has proven difficult.

This is challenging because blockchains are closed systems that do not have direct access to real-world data and thus, because they lack timely and accurate data, it is hard for DeFi applications to operate with the same level of sophistication as traditional financial products.

Note that the Oracle problem also exists within the world of blockchains: the different ecosystems are not compatible. For example, an application built on Ethereum is isolated from everything built on Solana. But this is a different problem with other solutions.

The Solution

Pyth Network aims to bridge the gap between real-world data and blockchains by providing high-fidelity financial market data directly on-chain.

Here’s how it works:

- Data Providers: Pyth Network collaborates with various data providers, including traditional financial institutions and crypto exchanges, who contribute their data to the network. The providers are often experts or specialists in their specific fields, ensuring the data's accuracy and reliability.

- Decentralized Network: The data from providers is aggregated on a decentralized network. This means it doesn't rely on a single source or entity, which helps preventing manipulation and ensuring the data remains unbiased and secure.

- High Frequency: Pyth updates this data at a very high frequency. This is crucial for trading environments where prices can change rapidly within seconds.

- Integration with Smart Contracts: The data is then made available on-chain and can be integrated into smart contracts on for example Ethereum or Solana. This integration allows DeFi applications to use real-time data for executing trades, managing portfolios, and more, just like in traditional finance.

- Broad Access: By making data publicly available on the blockchain, Pyth ensures that anyone building DeFi products can access quality data, which helps foster innovation and growth in the blockchain space.

In essence, the Pyth Network aims to make decentralized financial products more robust, reliable, and able to compete with traditional financial products by providing them with the high-quality data they need to function effectively.

My Thesis on PYTH

In my view, there are two things needed for Pyth network to be successful:

- Increased demand for Oracle solutions.

- A competitive advantage against other Oracle solutions.

Let's address them separately, and summarize at the end.

1. The Demand for Oracle Solutions

Almost everything in DeFi depends on (more or less) real-time, tamperproof, and reliable data streams from Oracle solutions, creating a strong demand for projects like Pyth Network.

Consider a DeFi project like Synthetix, which allows trading of synthetic assets mirroring real-world assets like stocks, oil, or gold.

- Accurate Prices: Synthetix needs real-time and accurate asset prices of the real-world asset that the synthetic asset is mirroring to function correctly.

- Risks of Inaccurate Data: If the price data is wrong, users might create or trade synths that are incorrectly priced, leading to losses or unfair gains.

For traders to trust Synthetics, a decentralized and unbiased price-feed is necessary. The only way to achieve this is to connect Synthetics to an Oracle, like Pyth Network.

In essence, without reliable data from a service like Pyth Network, Synthetix and similar projects would fail to maintain accurate trading environments and user trust would plunge.

As the general crypto market, and especially the DeFi market grows, the demand for Oracle solutions will increase.

2. Competitive Advantage

The Oracle space is not huge. There are only a few big players, and Chainlink (LINK) is the biggest, by far.

There are two ways to compare the adoption of Oracles:

- Total value secured: The value of all smart contracts reliant on data from the specific Oracle Solution.

- Protocols secured: Amounts of protocols (dApps) using the Oracle solution.

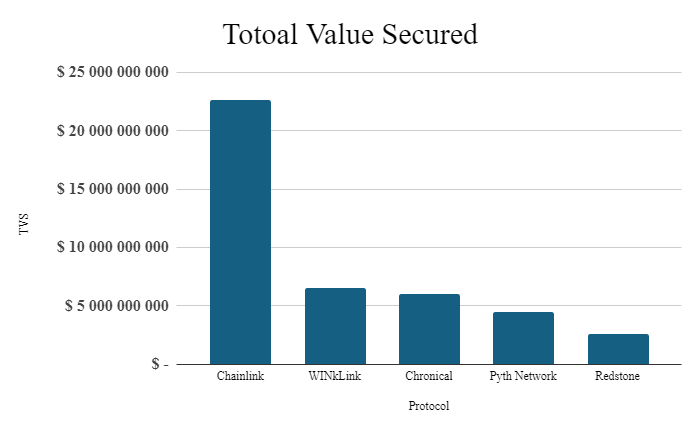

In terms of Total Value Secured, here are the top five Oracle solutions:

With almost $25 billion secured, Chainlink is clearly the leading Oracle solution.

In fact, Chainlink secures the same as the rest of the solutions combined.

Pyth Network might not stand out in terms of total value secured, nonetheless, it performs well when it comes to Protocols Secured.

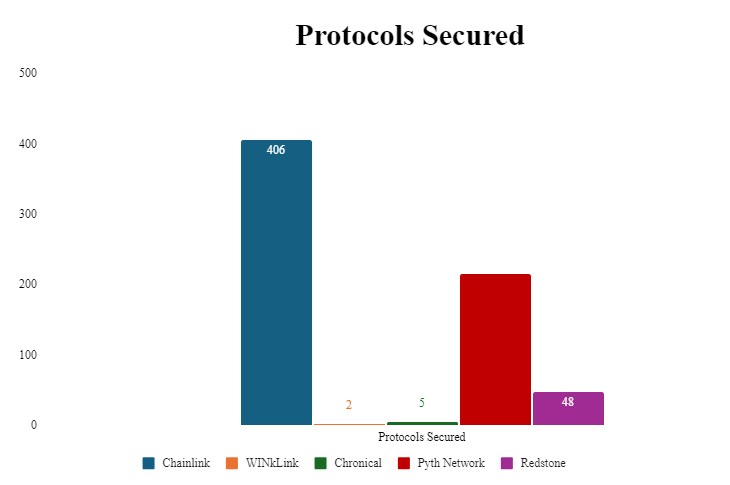

Look at the same solutions we saw in the graph above, but now in terms of protocols secured:

This paints a different picture.

Pyth is closing in on Chainlink, and the others are left in the dust.

Here are a few facts about the other top 5 solutions:

- WINkLink is just on the Tron blockchain, which makes it more or less irrelevant when looking at the competition of Pyth Network.

- Chronical is more or less only used by Maker DAO, one of the leading lending protocols on Ethereum. Therefore, it is not in direct competition with Pyth in terms of capturing new projects/value to secure.

In other words: The only real competition is between Chainlink, Pyth Network and Redstone.

Pyth Network vs. Chainlink and Redstone

Chainlink is highly established with a broad network, while Redstone offers cost-effective and customizable data feeds suitable for diverse needs.

While Chainlink and Restone are great general-use Oracle solutions, Pyth Network focuses on the finance niche. This gives them an edge.

Here are some of the reasons why Pyth Network is better than Chainlink and Redstone:

- High-Frequency Data: Pyth specializes in delivering real-time financial data essential for markets where data needs are measured in milliseconds. Pyth’s data feeds update in sub-second intervals, which is orders of magnitude faster than Chainlink. Redstone is the only true competitor in this aspect.

- Direct Source Data Providers: Pyth uses data directly from financial entities like trading firms and exchanges, potentially enhancing accuracy. Data from Pyth comes from primary market participants, offering the depth and reliability needed for complex financial analysis. Chainlink uses lots of third-party data, like CoinMarketCap, which adds a layer of risk to the data validity.

- Financial Markets Focus: Tailored for high-stakes financial environments, Pyth offers specific solutions like stock, commodities, and FX data, ideal for financial applications.

While Pyth Network might be best in the finance niche, Chainlink and Redstone cater to a broader range of applications and might be preferable for projects needing varied or less frequent data updates.

I think that Pyth Network can capture a significant portion of the market, especially within finance. With the current trend for decentralization and tokenization, I think the future for Oracles in general is bright.

Pyth Network Price Prediction

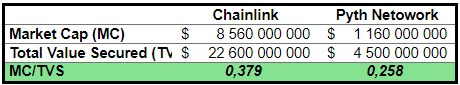

Let's get an idea of the valuation of the different Oracle solutions relative to the total value secured.

To measure the current valuation, I'll divide the market capitalization by the total value secured.

Below you see the market capitalization divided by the total value secured for Pyth Network and Chainlink:

Both are similarly priced, roughly at 0.2 of TVS. Pyth Network has a TVS at 15% of Chainlink.

Based on the following three assumptions, I'll predict the future price of PYTH based on the 0.2 of TVS valuation.

- Chainlink will reach a TVS 2x higher than at the peak of 2021.

- Pyth Network seizes 2x more market share, reaching 30% of Chainlinks TVS.

- The valuation of Pyth Network stays at 0.258 of the TVS.

Let's go through the implications of each of the three assumptions and make a prediction of the price of PYTH.

1. Future Chainlink TVS

At the peak of 2021, Chainlink reached a TVS of $93 billion. At the peak, its market cap was $23 billion, putting the MC/TVS ratio at 0.24, which is even higher than our assumed future valuation of PYTH, making our assumption conservative (that's a good thing).

If Chainlink reaches a TVS 2x that of the peak in 2021, it will reach a TVS of $186 billion.

Let's move to the second assumption.

2. Pyth Network sizes more market share

If the Pyth Network sizes 2x market share relative to Chainlink, its TVS will reach 30% of Chainlink.

Given these assumptions, the future TVS of the Pyth Network is:

Future TVS = $186 Billion * 30% = $55.8 Billion.

3. Valuation stays at 0.2 of TVS

Given the predicted TVS of $55.8 Billion, the market cap will reach:

Future Market Cap = $55.8 Billion * 0.258 = $14.4 Billion

The current market cap of Pyth Network is $1.23 Billion, putting the predicted increase in market cap at roughly 11.5X.

Future value of Pyth

In calculating the potential value of PYTH (the native token of Pyth Network), we need to take the circulating supply into consideration.

Below you see the supply increase. Month 1 refers to September of 2023:

|

|

Around March 2025 the supply will increase from 3.6 billion tokens to roughly 6 billion.

This is roughly a 66% increase in the circulating supply, which negatively impacts the price per token.

The price can be calculated as follows:

Price = Market Capitalization / Circulating supply

Therefore, with the estimated future supply of 6 billion PYTH and MC of $11.6 billion, the predicted price is:

$14.4 billion / 6 billion = $2.4

Conclusion

Given our assumptions and speculation, PYTH might be priced at $2.4 when the supply increases to 6 billion.