Ethereum (ETH)

Sep 01, 2024Ethereum, in simple terms

Ethereum is what we call "a layer one solution" (L1), meaning that it is an independent blockchain with its own validation mechanism.

What is important, is that you can build stuff on it.

Just like websites and applications are hosted on the internet, developers can host decentralized applications (dapps) on L1s.

These dapps range for decentralized echanges, to gaming platforms, to layer 2 solutions.

What they have in common is that they store information on the Ethereum blockchain.

Take Uniswap (UNI) for example.

It is the leading decentralized exchange and is built on Ethereum.

This means that all the transactions on Uniswap are finalized on the Ethereum blockchain.

The adoption of Ethereum vs. Competition

Competitors of Ethereum are other L1s like Solana (SOL) and Avalanche (AVAX).

Lets compare the largest L1s by comparing number of dapps.

Below you see how much of the Decentralized Finance (DeFi) market is built on the different blockchains:

With more than 65% of the DeFi market, Ethereum is by far the largest L1 in terms of adoption

The closest competitor is Solana, with less than 8%.

This means that Ethereum is 7x the size of its closest competitor.

Lets have a closer look at the top ten blockchains:

1. Ethereum

2. Solana

3. BSC

4. Tron

5. Arbitrum

6. Base

7. Avalance

8. Aptos

9. Sui

10. Scroll

Some of these are L1 blockchains and some of them are L2s.

As I said in the beginning, L2 are blockchains that are connected or built on a L1.

Of the top ten blockchains, the once I have bolded (Arbitrum, Base, and Scroll) are layer two solutions using Ethereum for finalization.

These are blockchains running on top of Ethereum. They batch up transactions to save processing power and space, and send them to Ethereum to be confirmed.

In other words:

Ethereum natively has over 65% of the DeFi market, and 3 out of the top 10 most used blockchains are built on Ethereum.

This means that about 70% of the DeFi market is finalized on Ethereum.

Furthermore, the trend for Ethereum is stable:

This confirms that Ethereum is, and for the foreseeable future, will be the largest L1 by far.

Number of protocols

Another way of comparing blockchain adoption is the number of protocols (applications like Uniswap).

Higher number of protocols (dapps) equals higher adoption.

Below you see the top ten L1s ranked by protocols:

Again, we see Ethereum at the top.

Further, 4 of the top 10 in terms of number of protocols are Ethereum layer two solutions.

These are:

- Arbitrum (#3)

- Polygon (#4)

- Base (#6)

- Optimism (#8).

All the protocols on these four blockchains are using Ethereum for finalization.

In total, that amounts to 2,838 protocols. Roughly 4x that of its closest competitor Binance Smart Chain (BSC).

Future of Ethereum

Lets use the future potential price of Bitcoin to get an idea of the future price of Ethereum.

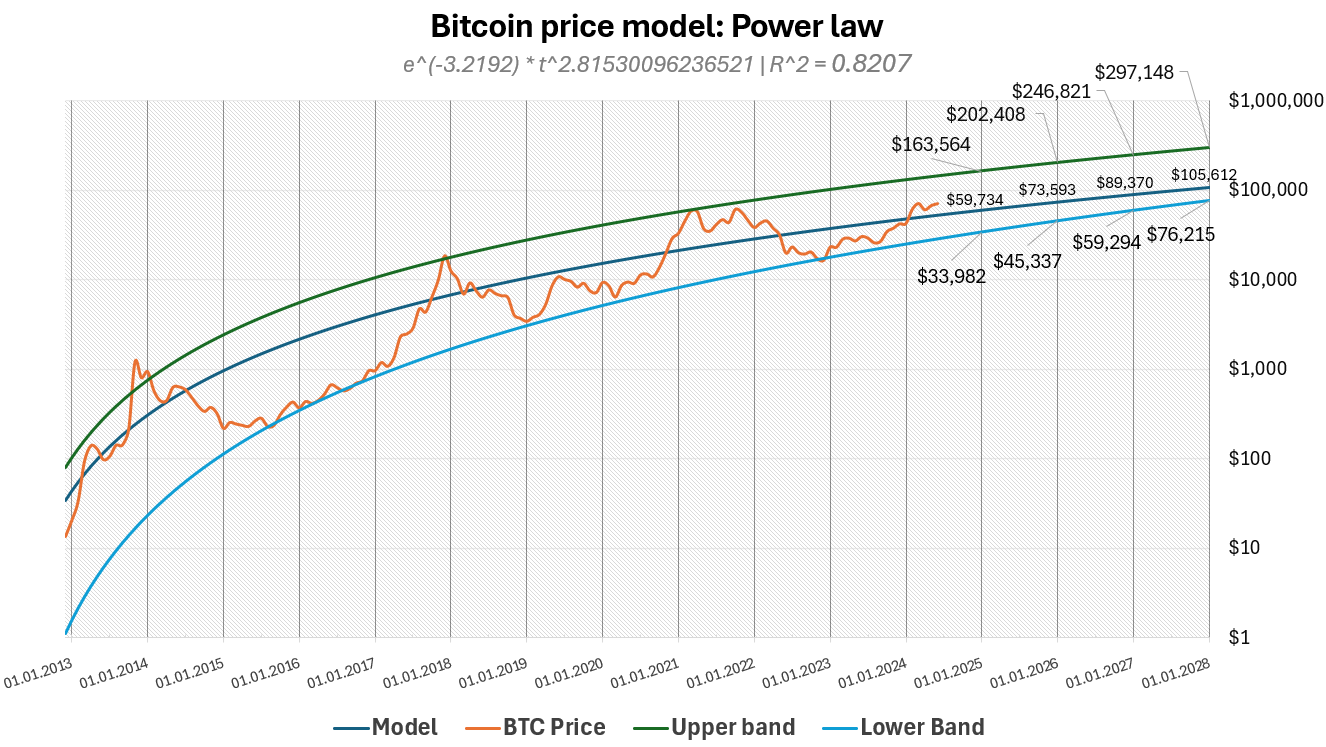

Below you see a price model for Bitcoin which indicates potential prices for Bitcoin depending on the timing of the next bull run:

It gives us the following potential tops:

Scenario 1: $164k

Scenario 2: $202k

Scenario 3: $246k

Scenario 4: $297k

For example, if Bitcoin peaks in 2025, we get a price between 164k to 202k.

Now, lets look at the relationship between ETH and BTC:

The graph shows us how much ETH has ben worth in terms of BTC.

For example, 1ETH was worth 0.085 BTC in September 2022.

If history repeats itself, we can assume that ETH will be worth everything from 0.057 (low) to 0.085 BTC (high).

In this thought experiment, I will give you four scenarios based on the BTC tops provided by the Bitcoin price model.

Further, I'll predict the potential ETH price based on the relationship between ETH and BTC.

I calculate one scenario where 1ETH = 0.057 BTC (LOW) and one scenario where 1ETH = 0.085 BTC (HIGH).

Scenario 1:

HIGH: 1 BTC is worth $164k, 1 ETH is worth 0.085 BTC. $164,000 x 0.085 = $13,940.

LOW: 1 BTC is worth $164k, 1 ETH is worth 0.057 BTC. $164,000 x 0.057 = $9,350.

Scenario 2:

HIGH: 1 BTC is worth $202k, 1 ETH is worth 0.085 BTC. $202,000 x 0.085 = $17,170.

LOW: 1 BTC is worth $202k,1 ETH is worth 0.057 BTC. $202,000 x 0.057 = $11,514.

Scenario 3:

HIGH: 1 BTC is worth $246k, 1 ETH is worth 0.085 BTC. $246k x 0.085 = $20,910.

LOW: 1 BTC is worth $246k, 1 ETH is worth 0.057 BTC. $246k x 0.057 = $14,022.

Scenario 4: $297k

HIGH: 1 BTC is worth $297k, 1 ETH is worth 0.085 BTC. $297k x 0.085 = $25,245.

LOW: 1 BTC is worth $297k, 1 ETH is worth 0.057 BTC. $297k x 0.057 = $16,929.

Conclusion:

Depending on the timing of the next bull run, and the relationship between BTC and ETH, we estimated the price of Ethereum to be, in the worst case $9,350 and in the best case to be $25,245.