Chainlink (LINK)

Sep 02, 2024Chainlink, in simple terms

I think the coming cycle will be the one where we see actual real-world applications of blockchain-based solutions.

Sure, we've seen some adoption, but only a fraction of what's possible.

With the ETF approval signalling acceptance of Bitcoin and crypto in general, I think companies are going to take a more serious look at the amazing solutions they can benefit from.

But to succeed with real-world application, crypto has to solve the "oracle problem".

Basically, the Oracle Problem refers to the fact that blockchains don't communicate with the real world. They are closed systems and there is a "gap" between the blockchains and the world outside them.

What is needed for blockchains like Ethereum and Solana to be useful in the real world are so-called "Oracles":

Chainlink (and the Pyth Network which has its own article in the Altcoin Library) aims to solve this problem

Below, you see a visual representation of how Chainlink (or any other oracle service) makes blockchains and the real world able to communicate:

|

|

Through processes illustrated by the image above, oracles "secure value" by feeding smart contracts data needed to execute.

For example, a given smart contract might be programmed to execute when the oil price reaches $80. The only way for the smart contract to know the price of oil is through an oracle.

Needless to say, the number of use cases and absolute need for Oracles is critical and cannot be overstated.

There are many Oracles but Chainlink is leading the sector, by far.

The chart below shows how much value each of the top 5 oracles has secured:

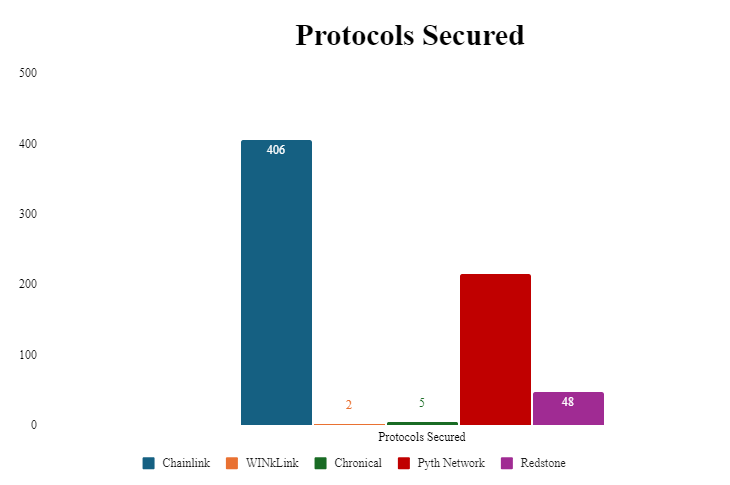

Another way of comparing oracles is by looking at the number of protocols they secure.

For example, Synthetix, a decentralized finance (DeFi) platform that allows users to create and trade synthetic assets, uses Chainlink to access real-world data. This integration enables Synthetix to offer synthetic assets that track the real-time price of external assets, such as currencies, commodities, and stocks, by utilizing the accurate and secure price feeds provided by Chainlink oracles.

Below you see the same oracles (top 5 by secured value), but this time we look at the number of protocols (like synthetics) they secure:

Chainlink secures way more protocols than the others.

In fact, Chainlink secures more protocols than its 15 closest competitors combined.

Read more about oracles here: https://chain.link/education/blockchain-oracles#toc-first

From a fundamental perspective, Chainlink seems like a great investment: there is a growing need for reliable oracles, and Chainlink is absolutely crushing the competition.

The next step is to look at the price from a technical perspective. Spoiler: it looks great there as well.

Let's begin by looking at the LINK/USD chart:

It looks long-term bullish, with a target of $53. That's roughly 5x from the current price. It might grow beyond that, but that is the minimum I expect LINK to reach this cycle.

Next, let us look at the LINK/BTC chart. This chart shows us the BTC-price of Chainlink. If this chart goes up, it means that LINK is outperforming BTC.

The BTC-price of LINK has been trending down since 2020, but late last year it broke out of a falling wedge pattern with a target of 0.00164BTC:

If we assume Bitcoin reaches $150K - $200K at the peak in 2025, this translates to:

0.00164 * $150K - $200K = $246 - $328.

Is that realistic? Probably not. But it paints a picture of what's possible for LINK. After all, it reached a BTC-price of 0.00164 back in 2020.

In my opinion, it's more realistic for LINK to peak in the $50 - $100 range.