Blast (BLAST)

Sep 01, 2024Blast, in simple terms

- Launch: Blast launched in November 2023.

- Innovation: Features native yield generation on ETH and stablecoins.

- Growth Milestones:

- Hosted over 200 decentralized apps (dapps) in six months.

- Secured $2 billion in total value locked (TVL) within dapps.

- Attracted 1.5 million users by Q2 2024.

- Became the sixth-largest blockchain economy.

- Developed by Leaders: Created by the team behind Blur, a well-known NFT marketplace.

Blast is a layer 2 scaling solution for Ethereum.

If you need to know more about layer 2 solutions, look at the articles on Polygon and Arbitrum where I explore the purpose of L2s.

Like Polygon and Arbitrum, Blast is built to scale and enhance efficiency on the Ethereum blockchain.

It does so by using the optimistic rollup framework.

The technology allows for off-chain processing and bundling of transactions.

Together, these features make it possible to scale the TPS (Transactions Per Second) on Ethereum.

If you want to know more about the optimistic rollup technology, head over to the Arbitrum article where I explore it more in-depth (Arbitrum is another optimistic rollup solution).

What is important is that you can use Blast to build dapps like decentralized exchanges.

As there already exists many L2s, new projects like Blast need unique features to succeed.

Features that make Blast stand out are the native yield and its own native stablecoin USDB.

As stated in their whitepaper:

"Blast is the only Ethereum L2 with native yield for ETH and stablecoins."

In other words, Blast has positioned itself as the only L2 helping its users earn money passively.

And the feature is rare if you take into account that there are more than 80 L2s just on the Ethereum network.

I'll look at the unique features of Blast (native yield and USDB) before discussing tokenomics and adoption.

Native Yield

To understand how the native yield on Blast works, one has to understand Proof-of-Stake.

Proof-of-Stake (PoS) is a consensus mechanism.

A consensus mechanism has two main functions:

- To validate transactions

- To incentivize good behavior.

Basically, it ensures the security of the network by preventing issues like double-spending.

Ethereum started out with Proof-of-Work (PoW) where miners solve complex mathematical problems to validate blocks (just like Bitcoin).

In 2022, they changed to Proof-of-Stake (PoS).

With PoS, validators stake tokens to get a chance to validate transactions. The staked tokens act as a guarantee that they are operating in good faith.

And the incentive to stake tokens is yield.

Yield is just profit generated from holding assets.

So to sum it up: Staking is a security mechanism and the reason you would want to stake your tokens is to earn more cryptocurrency.

Now, the way Blast works is that it handles staking on behalf of its users.

In short, this means that the users themselves don't need to stake their tokens to earn yields.

The native yield for ETH is 4% and the native yield for stablecoins is 5%

Native stablecoin: USDB

Adoption of Blast: Airdrop

Despite its short history (it went live in February 2024), there have been launched more than 200 dapps on Blast.

In fact, this makes it the fastest-growing blockchain of all time.

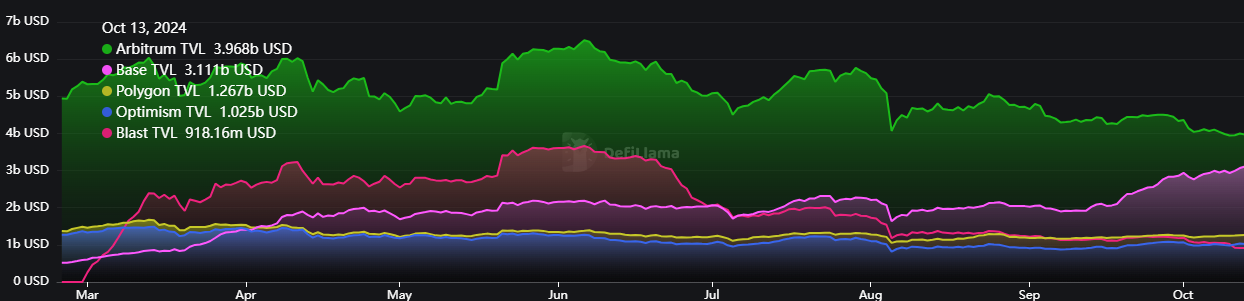

This is reflected in the rise in TVL from February 2024 (launch) to June 2024:

But from the spike in June, the TVL fell by two-thirds down to below 1B:

Not only did TVL fall, but so did the volume of DEXs on Blast:

Lastly, the price of the native token, BLAST fell 42% in 10 days, from 27. June to 07 July:

This is normal when a new token is launched. It happened with Arbitrum, Uniswap, and many others.

After an initial crash, the tokens start to rebuild, eventually breaking into new highs.

Let's look at how Blast is doing and speculate on its future price.

Is Blast undervalued?

I'll use the TVL/MC metric to explain why I think Blast is undervalued.

- TVL = Total Value Locked: The value currently being held or locked within the platform's financial protocols, such as decentralized apps (dapps) and staking solutions.

- MC = Market Capitalization: The price per token multiplied by the number of tokens. Basically, the value of the protocol.

We can think of TVL as the adoption and MC as the valuation of the protocol.

Since there is a strong correlation between adoption and valuation, we can compare the TVL divided by the MC of Blast to other Layer Two protocols (L2) like Polygon and Arbitrum.

TVL of the top five L2s:

- Arbitrum: $4 Billion

- Base: $3 Billion

- Polygon: $1.26 Billion

- Optimism: $1 Billion

- Blast: $0.92 Billion

MC of the top five L2s:

- Optimism: $2.2 Billion

- Arbitrum: $1.9 Billion

- Polygon: $1 Billion

- Blast: $0.19 Billion

- Base: doesn't have a token, hence no MC.

Let's use these numbers to calculate how undervalued it is by looking at the ratios of TVL and MC.

TVL / MC of the top 4 L2s:

Remember: High TVL and low MC = undervalued. Therefore, the higher the TVL / MC ratio is, the more undervalued the project is.

- Polygon: 1.26

- Optimism: 0.45

- Arbitrum: 2.1

- Blast: 4.84

My interpretation of the numbers is that Blast is much CHEAPER than the other L2s.

Opportunities like this exist because the crypto market is not yet "mature". The maturity of a market basically means how quickly arbitrage opportunities are taken.

Since crypto is rapidly maturing, this apparent discrepancy in valuation is likely to close, leading to an increase in the market cap of Blast of somewhere between 2.5x and 10x to normalize its TVL / MC ratio.

Blast sounds like a no-brainer, right?

Well, it's not that simple...

For example, Polygon is more than just an L2 for Ethereum. The ecosystem is way more ingrained and technology is more sophisticated.

Therefore, comparing these based on TVL / MC only paints half the picture.

Furthermore, we need to take the tokenomics of Blast into account. There will be significant inflation, as the token is still in early-phase distribution.

This inflation of the supply will lower the price of Blast, given a constant market capitalization.

Tokenomics

Here's a pie chart of the planned distribution of tokens:

Community means users and applications on Blast. The recent airdrop of 17% of the supply sent 14% to the community.

Users of Blast earn points over time, making them eligible for the next airdrop, which is scheduled for July 2025.

It's hard to find exact information about the planned token inflation, which is what I'm most interested in, but it looks like a more or less linear inflation until the next major airdrop in July 2025.

In other words, the inflation will not be significant for the next 12 months.

Blast: Conclusion

- In the one-dimensional, but still valid, analysis of TVL / MC, Blast is severely undervalued.

- The tokenomics are good for the next 12 months.

- It is not yet listed on Binance. When it does, it will likely act as a catalyst for the price.

- Using Blast makes you eligible for the next airdrop, acting as a strong incentive for users and developers to adopt Blast.