The Trading Dashboard

Last update: March 30th

Summary: Altcoins are cheap

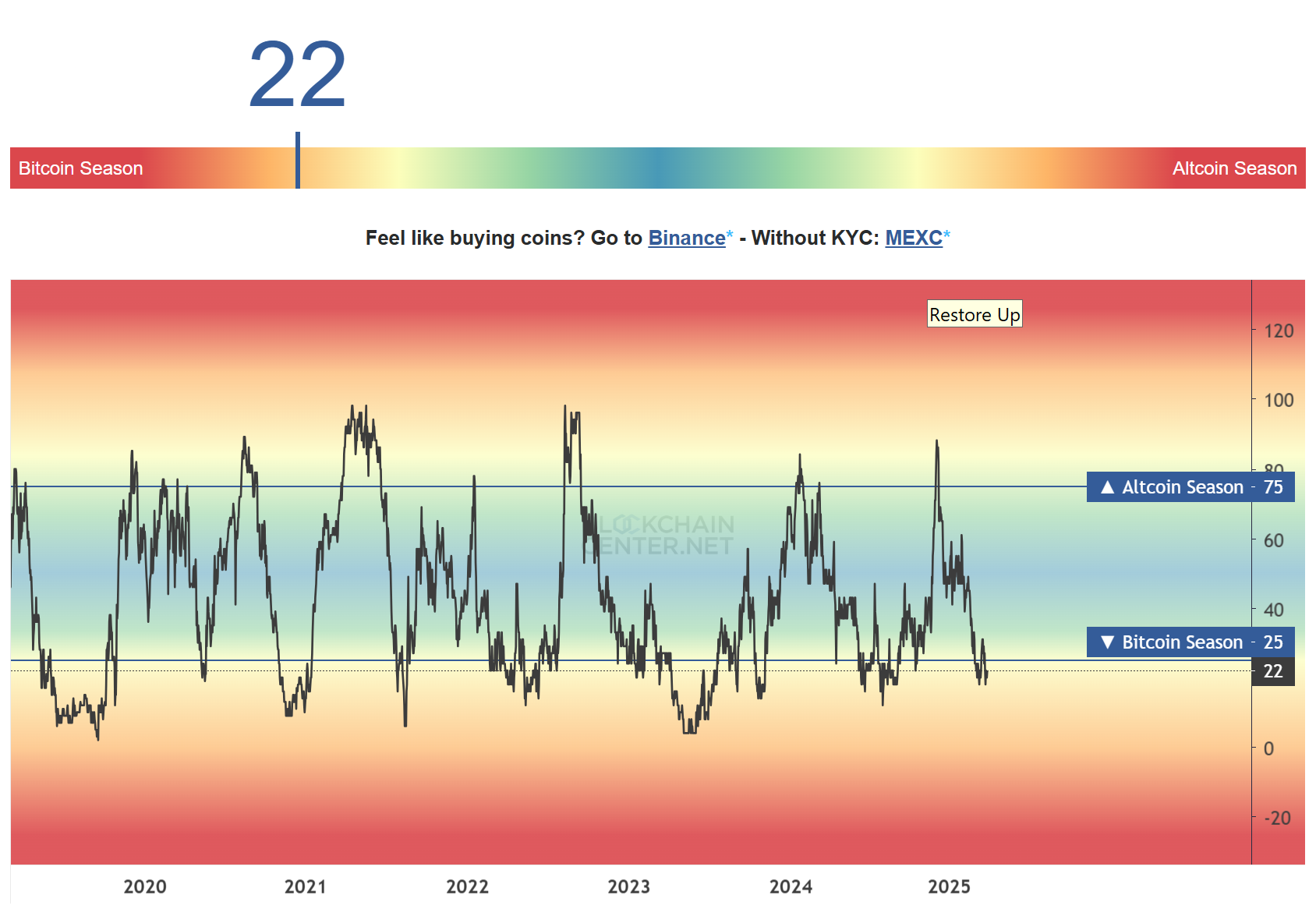

The Altcoin Season Index: At 22, we're officially in Bitcoin season. This means that altcoins in general have underperformed BTC for the past 90 days, and therefore, that altcoins are cheap relative to BTC.

The Bitcoin Dominance: At 62%, altcoins are relatively cheap. According to Market Cycle theory, dominance will begin a long-term downtrend soon, ushering in a major altcoin season. Therefore, in the long term, altcoins seem like a great buy at current prices.

Even though this indicator tells us that altcoins are the best long-term bet, the Altcoin Season Index tells us that altcoins in the mid-term might be volatile in both directions. Gradual accumulation of altcoins is the way to go here.

The Others Dominance: It successfully bounced off the support line, but has corrected down again. This means that small/medium-sized alts are relatively cheap at the moment but also increase short-term risk. A confirmation of the downtrend of BTC dominance is likely to accelerate this trend and make small/medium-sized alts surge.

*Not financial advice*

Altcoin Season Index: 22/100

The Altcoin season Index is a number between 1 and 100. The number equals the percent of the top 50 altcoins (excluding stablecoins) that have outperformed Bitcoin in the past 90 days.

For example, if the index is at 45, it means that 45% of the top 50 altcoins have outperformed Bitcoin in the past 90 days.

Altcoin Season = Above 75.

Bitcoin Season = Below 25.

We want to buy Altcoins during Bitcoin season and sell altcoins during altcoin season.

The Bitcoin Dominance 62.28%

Bitcoin dominance measures Bitcoin's share of the total cryptocurrency market capitalization.

When Bitcoin Dominance is high, it means Bitcoin holds a larger part of the market, and that altcoins are cheap relative to Bitcoin.

When Bitcoin Dominance is low, it indicates that altcoins are expensive relative to Bitcoin.

Example:

If the total cryptocurrency market is worth $1 trillion and Bitcoin's market cap is $700 billion, Bitcoin's dominance is 70%. If the total crypto market grows to $1.5 trillion but Bitcoin remains at $700 billion, Bitcoin Dominance drops to around 46.7%, indicating a shift in investment towards other altcoins.

Therefore, we want to hold altcoin when the Bitcoin dominance decreases.

The Others Dominance 8.38%

Others Dominance measures the market share of altcoins below the top 10 in terms of market capitalization.

When Others Dominance is high, small- and medium-sized altcoins collectively hold a significant portion of the market.

Conversely, a low Others Dominance signifies that the majority of investment is concentrated in the top 10 cryptocurrencies.

Example:

- If the total cryptocurrency market is valued at $1 trillion and the market cap of altcoins outside the top 10 sums up to $100 billion, Others Dominance is 10%.

- If the total market cap increases to $1.5 trillion but the market cap of these smaller altcoins remains at $100 billion, Others Dominance would decrease to about 6.67%.

Therefore, we want to hold more small- and medium-sized altcoins than large altcoins when Others Dominance increases.